The Ethical Investor

"We only just moved in here from an open plan office upstairs" he said as we sat down at a fancy new boardroom table with surprisingly comfortable chairs.

"The previous tenants moved out and left their furniture" he quickly added laughing, "it's a nice change from the IKEA desks we used to have. Next we need to be in a sustainable building."

The offices of Canberra start-up company Future Super represent the culmination of a long and interesting journey for Adam Verwey.

A former president of the UC Student's Association, candidate in both ACT and federal elections, philanthropist and expert on ethical investment and corporate responsibility it has been an unusual path to becoming an entrepreneur for the 31 year old from Broken Hill.

While traditionally advocates for a cause build awareness and push for change through lobbying, Adam has taken a different approach to tackling the problem of climate change.

Unlike many other start-ups, Future Super not only exists to make a profit for its members, but also to make a positive social change in Australia through the use of market forces.

Voting with your money

"You get to vote once every three years at an election, but every day you can vote with your money."

For the vast majority of us, superannuation is something we only think about once a year when we receive our account statement. But our super accounts hold much more power than we realise, power that can be used to make positive change in the world.

"Individually it seems like we don't have a lot of money, but collectively there's so much money there" Adam explained, "Superannuation is a two trillion dollar industry. And you can use that to create great positive change."

You get to vote once every three years at an election, but every day you can vote with your money

From fossil fuel and logging companies which harm the environment, to gambling providers and tobacco companies which affect our society, weapons manufacturers, and companies with poor corporate governance, involved in corruption, bribery or slave labour, all borrow money from banks through our savings and super accounts.

But this doesn't have to be the case.

According to Adam, given the chance most Australian's would rather their investments make a return as well as be socially responsible.

"Research shows again and again that the potential market is about 50 to 60% of the population.

It's about a large group of people using their money in a way that can influence the future we want to have. To move into industries that help create a better and more sustainable and caring community."

Profit for purpose

After their unsuccessful campaigns in the 2013 Federal Election, Adam and running mate Simon Sheikh were determined to make a difference to climate change.

With nine years of experience in the investment industry and given the current government's stance on climate change, the most effective way to influence positive change was clear for Adam.

"The biggest thing we can do right now for climate change is to move the market away from fossil fuel industries. To be a product provider who can help facilitate the fossil fuel divestment movement."

With angel investments from fellow climate change campaigners including Simon Holmes a Court and Caroline Le Couteur, and a board of likeminded finance experts Future Super was born.

"It took Simon and I several months to get the fund up and running, which is a really short time in financial services. But when you're trying to create change on an issue as urgent as climate change, those few months can feel like a really long time" said Adam smiling with a hint of realisation of just how far he has come in a very short period of time.

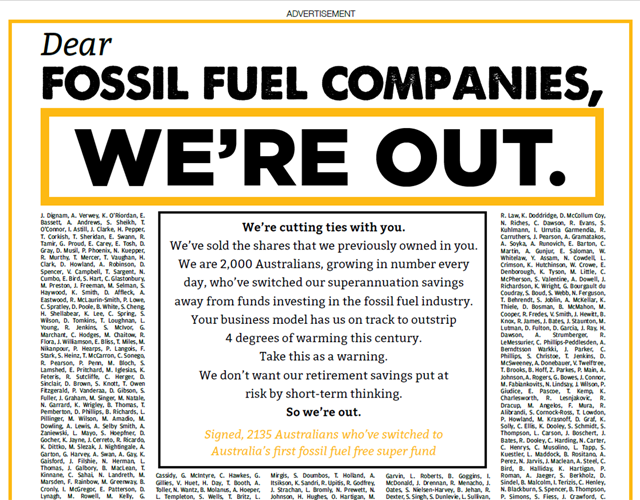

In May Future Super ran a full page letter to fossil fuel companies in major newspapers, generating significant public interest

The movement grows

Launched in September 2014, the speed and size of the growth of Future Super has exceeded even Adam's wildest expectations.

Within three months 1000 people had moved their super accounts to Future Super. Now only seven months later the fund has more than 2700 members, $70m under management and seven full time staff.

"Every day you see 15 or 20 people joining our super fund and you look at the names and think 'I don't know any of these people', and yet they've found out about this fund we've created, and joined it and trusted us with their money. It doesn't sound like a big thrill, but it's a constant thrill to see so many people taking action with their money every day" said Adam beaming at the growth of the business so far.

Even with so much success, Adam was still easily able to point out his highlight so far.

"When our fund reached the $50 million mark.

We'd looked at that as the point at which we could be on to something successful, and we reached it much more quickly than we thought. The moment we went up to the whiteboard and wrote $50 million it was just a really special moment for us and we felt like our hard work had started to pay off."

We think we can be the first domino that topples all those other super funds

In such a competitive industry it's not surprising that Future Super's success has started to make waves. Competitors HESTA and Uni Super have removed fossil fuels from some options for members, and Adam sees other funds following suit in the near future.

But rather than worry about increased competition, Adam welcomes and even encourages the change.

"One of the theories of change behind what we are doing is that we want all super funds to be fossil fuel free. We don't create the change we want to see if every other super fund continues to invest in and continues to support the fossil fuel industry. We think we can be the first domino that topples all those other super funds."

The start-up changing the world

"Every day I can come into work and feel like I am making a difference."

While being a new entrant into mature and institutionalised industry might seem like a daunting task, according to Adam Future Super's ability to be flexible and explore new ideas gives them an advantage over many of their well-established competitors.

"It's very exciting to be in an environment where someone might have an idea that might sound a bit out there at first, then we think about it a bit more, and realise that's its actually a great idea and have everyone jump on board and implement the idea.

If it works it works and that's great, and if it doesn't work that's fine too. We're at a stage where those things happen frequently, no one here has a typical day."

It's just a really great environment to be in, and I'm really lucky

The generation of innovative ideas hasn't come by accident though. Adam credits the wide range of backgrounds in the founders and staff for Future Super's pioneering culture.

From their online marketing strategies, the use of brand ambassadors and development of new products such as fossil fuel free home loans and pension funds, fresh eyes from non-finance backgrounds have been key to the amazing growth of the business so far.

"It's just a really great environment to be in, and I'm really lucky to have that because it's not an easy environment to find."

Adam's 3 steps for changing to an ethical super fund

If you are very concerned about climate change and want to use superannuation or other funds in your bank account to make a big difference there are three easy steps to do it:

1. Contact your bank or super fund

Tell them that you are a member/customer and that you don't like that they fund things like fossil fuels with your money. Ask them to stop investing in those things, or you will be switching your money. Make sure you wait to get a response, never just switch your funds.

2. Switch your funds

If you're not happy with their response, let your bank and super fund know that you have just switched and the reasons why. If you're switching your bank accounts you should go into the bank and tell the person at the counter the reasons why you are switching and ask them to tell the manager.

3. Tell you friends, family and colleagues

That you have chosen to make a change because your bank or super fund is investing in fossil fuels. Let them know how easy it was, and ask them to do the same.

It's not just a matter of making a small administrative change, it's about

making a big deal about it. That's how we make the change.

Words by Daniel Murphy